E-Invoice using SAP Business One

E-invoices must adhere to the GST invoicing rules. Apart from this, it should also accommodate the invoicing system or policies followed by each industry or sector. Certain information is mandatory whereas the rest of them are optional for businesses. Also, each e-invoice has to be registered individually and cannot be processed en masse.

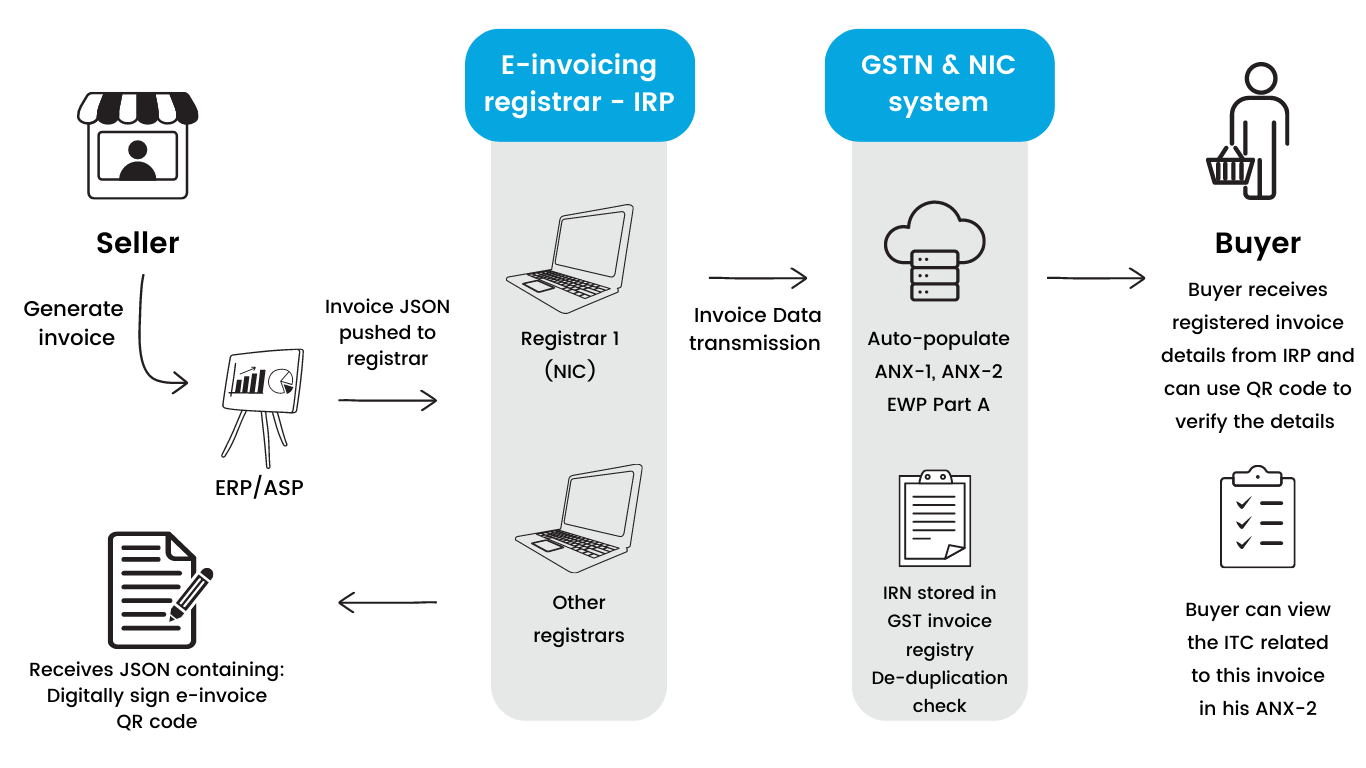

E-invoicing in SAP does not mean that the company must create its invoice using the government’s software system. Instead, it means that the company must submit information about their already generated invoice from their ERP system to the Invoice Registration Portal (IRP). On doing this, they receive the unique IRN (Invoice Reference Number) and a QR code from the portal, which needs to be printed/displayed on their invoice. The broad process flow of the E-invoicing system is displayed below.

SAP Business One offers two options for the actual solution deployment and usage to customers

Benefits of E-invoice

Reduces Data Errors

E-invoicing in SAP ensures that invoices get uploaded on the common portal to facilitate multipurpose reporting. The portal auto-populates the details and ensures there is no need for manual data entry while filing GST returns

Prevents Tax Evasion

Since most of the processes happen online, Instances of data manipulation reduce to a great extent as invoices are generated before a transaction occurs. Tax officials have easy access to the output tax details and the input tax credit

Create E-way Bill

Generated with the help of E-invoicing. Since most of the processes happen online, the taxpayer needs to update the vehicle details only and the Part-A of the e-way bill will be updated with the details automatically from the authenticated e-invoice

Generate QR Code

GST invoices are used to calculate the ITC amount. However, an assessee can misplace an invoice or want additional copies urgently. In such instances, the assessee can scan the QR code and generate invoices easily in a PDF format on the go

One-time Reporting

Allows a taxpayer to report their invoices one time. They can get it authenticated by the (IRP) which is responsible for validating invoices & issuing the (IRN)

Reduces Fraud

With real-time visibility of data shared with the tax authorities, the instances of fraud will be reduced as well. Because invoices get uploaded on the common portal

Track Invoices

With the help of e-invoicing and real-time access, suppliers can track their invoices efficiently. It also allows the input tax credit to be available quickly for the supplier

Helps Buyers

Once the E-invoice is uploaded on the GST portal, it is shared with the buyer for authentication. The buyer can then reconcile the purchase order & accept or reject the invoice in real-time